Forex consolidation is

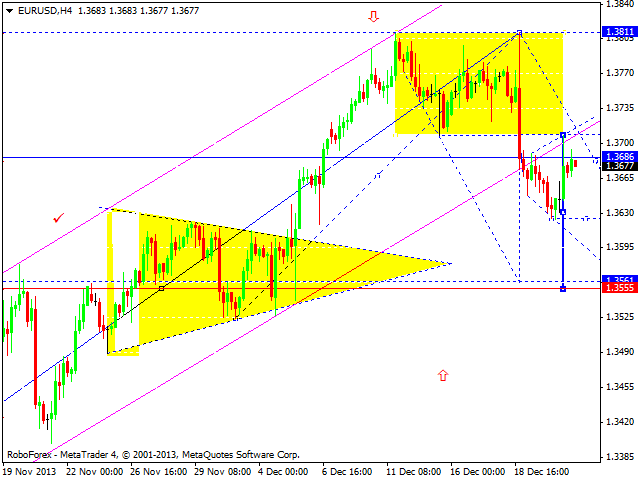

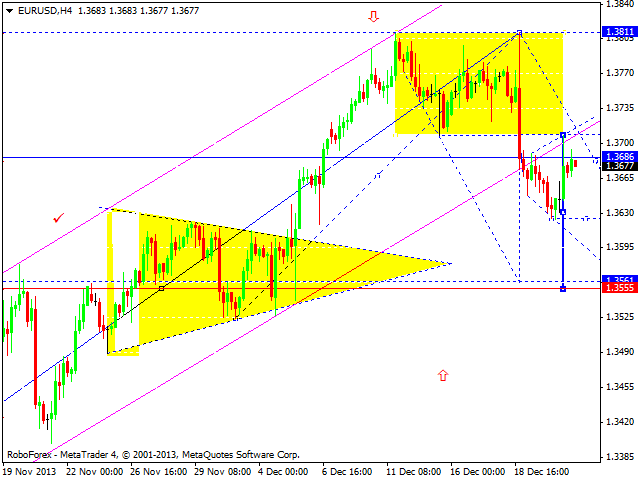

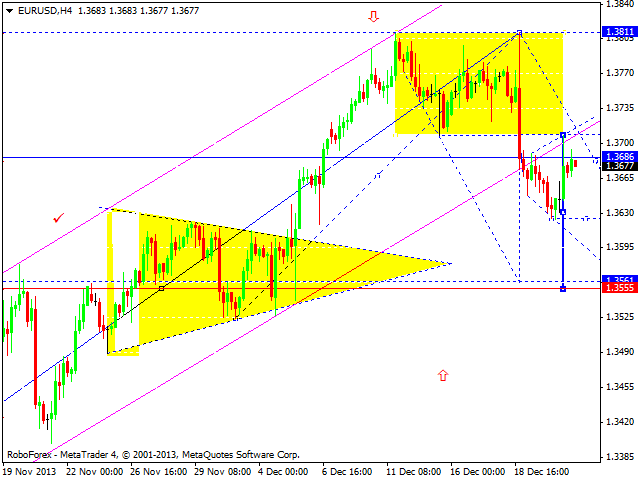

Much like the first dynamite compound invented by Swedish chemist and engineer Alfred Nobel, consolidation periods and patterns in the currency markets can explode, leading to great profit opportunities for the FX trader. Sometimes suggestive of indecision, consolidation periods are great for capturing potential because the burst of directional action that follows can last for an extended period. Understanding and trading on consolidation patterns will give the currency trader in the know two "edges". First, the trader can hold his or her initial position for a shorter amount of time, thus minimizing the risk of holding positions in the case of higher rollover interest. Second, the profit potential from such a position can be big, as long as the trader follows strict, disciplined money management rules. Without money management, the trader might as well be playing with fire. Here we look at two different consolidation patterns and give you a step-by-step explanation of how to trade them. The Flag - Continuation of the Trend The flag formation is one of two consolidation patterns that can lead to great profit opportunities. Common in the currency markets, the flag formation serves as an indication of continuation i. This type of consolidation occurs after a significant uptrend and is usually referenced as a stopping point before further strengthening momentum ensues. Similar to a staid rectangular consolidation pattern, the broadening formation is great for establishing a top in an uptrend or a bottom in a downtrend, and it is thus suggestive of a near-term reversal in the price action. Here, traders are consolidating their positions by establishing an upper and lower trendline. However, the swings become longer and larger as compared to earlier fluctuations. The flag formation consolidation opportunities to trade on a continuation basis, while the broadening formation offers opportunities in reversal situations. Either way, the trader will be taking advantage of the powerful directional bias that occurs following consolidative neutrality. Sometimes suggestive of indecision, consolidation periods are great for capturing potential because the burst of directional action that follows can forex for an extended period Understanding and trading on consolidation patterns will give the currency trader in the know two "edges". Here we look at two different consolidation patterns and give you a step-by-step explanation of how to trade them The Flag - Continuation of the Trend The flag formation is one of two consolidation patterns that can lead to great profit opportunities. Then we establish the upper trendline at point B by connecting the topside wicks. Note that both lines should be relatively parallel - any deviation may be indicative of a different pattern Zoom into the exact points where the price action approaches either the upper or lower trendline In Figure 2, we zoom in on an approach of the upper resistance ceiling. Once we have a close of the session above the consolidation, the entry should be placed 5 pips above the high. This would place the entry at point X Always place a corresponding stop loss Sound money management should always be applied to any trading position. The underlying theory is simply that if the price breaks back below the upper trendline, the close above was simply a fakeout and the trend is being contained. In this trade, the stop would be placed at see Figure Taking a short-term stance Here, a trader can hold for the day and close the trade before the New York markets close in order to avoid the rollover on the position. If the trader takes advantage of the short-term explosion, he or she has the potential to capture 95 pips profiting from the high at while maintaining a risk-reward ratio. But the trader can also opt to hold on for longer-term gains. If the trader holds on longer, he or she could realize a much larger profit - in this example, the move topped out at Figure X marks the perfect entry The Broadening Formation - Consolidation before the Reverse Like the flag formation, the broadening formation - our second consolidation pattern of choice - is also found in an uptrend, but it indicates a reversal of the trend, rather than a continuation. Here in Figure 3, we apply the lower trendline by connecting the lower wicks at point A. Then we connect the topside wicks at point B. Rather than run parallel as they do in the flag formation, the trendlines in this formation will diverge. This is suggestive of a break, so a currency trader would place the entry 5 pips below the low of the session. Forex this case, the trendline would be placed at and our subsequent stop at With 48 pips of room, due to the stop-loss order, we are now looking for a minimum of 96 pips in maintaining a risk-reward ratio Taking a longer term stance Although offering a consolidation direction in price, the broadening formation tends to spark longer-term trends. As a result, in this case a trader may decide to take profits at a risk reward or hold on to forex longer-term position. In the case of the longer term, the spot price declines before establishing a bottom at nearly pips from the entry, and a more than adequate risk-reward ratio Figure X marks a great entry for profit potential Conclusion Both of these consolidation patterns and their corresponding strategies can be executed by both the novice and the expert trader, allowing the individual to isolate great potential profit opportunities in a short amount of time. Profit-taking opportunities abound using this lesser-known pattern. Trendlines give an investor a good idea of the direction an investment might move in. Discover how to make them work for your portfolio. The following five rules will help traders find high profit potential, low risk, intra-day trades. Learn a stop-loss strategy that will help you protect your gains when trading breaks. These financial stocks recently broke above resistance, signaling another move to the upside. These stocks are near or approaching trendline support, which is often a favorable time to buy. Trending higher overall, and trading near support following a pullback, these stocks are in the buy zone. A method of identity theft carried out through the creation of a website that seems to represent a legitimate company. In the case of the longer term, the spot price declines before establishing a bottom at nearly pips from the entry, and a more than adequate risk-reward ratio Figure X marks a great entry for profit potential.

A lot of people think after some personal failures the people loose control about their life caused by alcohol or drug abuse and become homeless.

A new position has arisen for a Cruise Consultant with a. Totaljobs.com - about 4 hours ago - save job saved to my jobs - remove - share - more.

It is a mix between the word pharmaceutical and farm, and shows what the animals are used for.